You know that feeling. It’s a few days before payday, your bank account is looking a little… anemic, and a wave of anxiety washes over you. An unexpected car repair, a doctor’s bill, or even a friend’s birthday dinner invitation can feel like a financial crisis.

If this sounds familiar, you’re not alone. For so many of us, money feels like a mysterious, stressful force that happens to us. We work hard, the money comes in, and then—poof!—it’s gone, leaving us wondering where it all went.

But what if we told you it doesn’t have to be this way? What if you could transform your relationship with money from one of stress and scarcity to one of confidence and control?

The secret isn’t about making a six-figure salary or becoming a Wall Street wizard. It’s about mastering the fundamentals. It’s about making your money work for you, not the other way around.

Welcome to your no-judgment, step-by-step guide to taking back control. Here are 9 powerful, yet surprisingly simple, money management tips to not just improve your finances, but to improve your entire financial peace of mind.

1. The “Why” Behind the Buy: Get Brutally Honest About Where Your Money is Actually Going

Before you can build a budget, before you can set goals, you need one crucial thing: awareness. You can’t change what you don’t track.

Most of us have a vague idea of our spending. “I spend a lot on food,” or “My rent is expensive.” But vagueness is the enemy of progress. That $4 latte, the seamless lunch order when you’re too busy to meal prep, the subscription you forgot to cancel—these “little” things add up to a massive financial blind spot.

Your First Mission: Track Your Spending for One Month.

No fancy apps required unless you want them. You can use a simple notebook, the notes app on your phone, or a spreadsheet. The method doesn’t matter; the consistency does.

- How to do it: For one full month, write down every single penny you spend. Categorize it as you go: Groceries, Rent, Utilities, Eating Out, Coffee, Entertainment, Gas, Random Amazon Purchases, etc.

- The “Aha!” Moment: At the end of the month, add it all up. This is often a life-changing moment. You’ll see, in black and white, that you’re spending $200 a month on takeout or $80 on streaming services you barely use. This isn’t about shaming yourself; it’s about gathering intelligence. You are now operating from a place of knowledge, not guesswork.

2. Your Money Needs a Job: Create a Budget That Doesn’t Feel Like a Straitjacket

The word “budget” can feel restrictive, like a financial diet. Let’s reframe it. A budget isn’t a constraint; it’s a spending plan. It’s you giving every single dollar a specific job to do, whether that job is paying the electric bill, saving for a vacation, or buying a nice dinner. This puts you in the driver’s seat.

Forget complicated, color-coded systems that are hard to maintain. Let’s talk about one of the simplest and most effective budgeting methods out there: the 50/30/20 Rule.

This rule provides a balanced framework for dividing your after-tax income (your take-home pay).

- 50% for Needs: These are your essential, must-pay expenses. This category includes rent/mortgage, utilities, groceries, basic transportation (car payment, gas, insurance), minimum debt payments, and essential healthcare costs. If you can’t live without it, it’s a need.

- 30% for Wants: This is the fun part! This is for the things that make life enjoyable but aren’t essential. Dining out, hobbies, shopping, vacations, entertainment subscriptions (Netflix, Hulu), and that daily coffee.

- 20% for Savings and Debt Repayment: This is your future-you category. This money goes towards building an emergency fund, saving for retirement, and making extra payments on debt (like credit cards) beyond the minimum.

How to Get Started:

Take your monthly take-home pay and plug it into the 50/30/20 framework. Does your current spending fit these percentages? For many, the “Needs” category is too high. That’s okay! The goal isn’t perfection on day one. The goal is awareness and a direction to move towards. If your needs are 60%, see if you can find ways to shave that down to 55%, and so on.

3. Pay Yourself First: The Automatic Path to Wealth

This is, without a doubt, one of the most powerful concepts in personal finance. “Paying yourself first” means that before you pay your bills, before you buy groceries, before you do anything else with your paycheck, you set aside a portion for your future.

Why is this so revolutionary? Because it makes saving automatic and effortless. If you wait to see what’s “left over” at the end of the month to save, you’ll often find there’s nothing left. Life has a way of filling the space.

How to Automate Your Finances:

- Set Up a Separate Savings Account: Don’t just keep your savings in your checking account—it’s too easy to dip into. Open a dedicated savings account, ideally at a separate online bank that offers a higher interest rate. Out of sight, out of mind.

- Schedule Automatic Transfers: The day after your paycheck hits your checking account, set up an automatic transfer to your savings account. Start with whatever you can, even if it’s just $25 or $50 per paycheck. The amount is less important than the habit.

- Watch It Grow: You will be absolutely amazed at how quickly this money accumulates without you having to think about it. You’re not relying on willpower; you’re using a system. This is how you build your emergency fund, your down payment, and your investment nest egg.

4. Build Your Financial Shock Absorber: The Emergency Fund

Life is full of surprises, and not all of them are pleasant. Your car transmission goes out. Your water heater bursts. You have a sudden medical expense. Or, as we’ve all recently learned, a global pandemic can hit and disrupt the economy.

An emergency fund is your personal financial shock absorber. It’s a pile of cash specifically set aside for these true, unexpected emergencies. It prevents you from having to rely on high-interest credit cards or loans when disaster strikes, which can send you spiraling into debt.

Your Emergency Fund Goal:

- Step 1: Starter Fund ($500 – $1,000): If you’re starting from zero, your first goal is a small starter fund. This will cover most minor emergencies and give you immense peace of mind.

- Step 2: Full Safety Net (3-6 Months’ Expenses): Your ultimate goal is to save enough to cover 3 to 6 months of your essential living expenses (the “Needs” category from your budget). This is your “I lost my job” or “I can’t work for a while” fund. It’s your financial security blanket.

Keep this money in a easily accessible savings account. It’s not for investing; it’s for security and immediate access.

5. Tame the Beast: A Strategic Plan for Conquering Debt

Debt, especially high-interest consumer debt from credit cards, is a massive anchor on your financial progress. The interest you pay is money that could be working for you in a savings or investment account, but instead, it’s flowing out the door to your creditors.

Tackling debt can feel overwhelming, but you can eat an elephant one bite at a time.

Two Popular Debt Repayment Strategies:

- The Debt Snowball Method: This method is all about psychological wins. You list all your debts from smallest balance to largest balance (regardless of interest rate). You make the minimum payments on all of them, but you throw every extra dollar you can find at the smallest debt. Once that smallest debt is gone, you take the total amount you were paying on it and roll it onto the next smallest debt. The “snowball” gains momentum as you go, and the feeling of paying off individual debts completely is incredibly motivating.

- The Debt Avalanche Method: This method is mathematically superior because it saves you the most money on interest. You list your debts from the highest interest rate to the lowest. You make minimum payments on all, but put all extra money toward the debt with the highest interest rate. Once that’s gone, you move to the next highest.

Which one should you choose? If you need motivation and quick wins to stay on track, choose the Snowball. If you are highly disciplined and want to optimize for interest savings, choose the Avalanche. The best method is the one you’ll actually stick with.

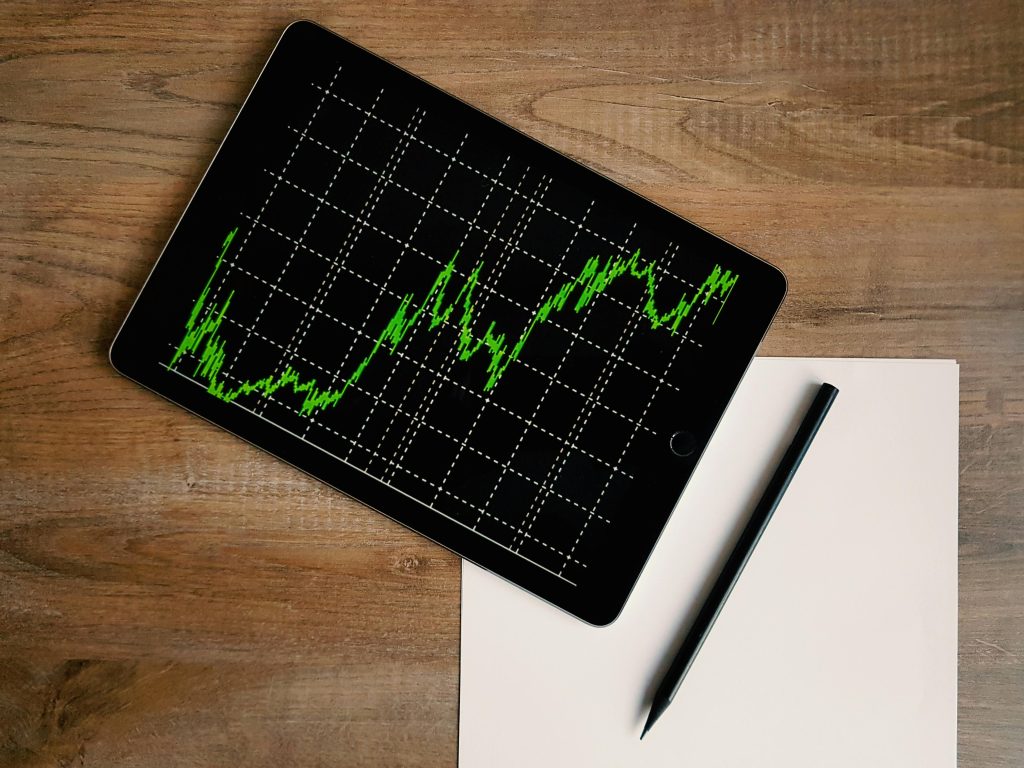

6. Your Future Self Will Thank You: Start Investing, Even If It’s Tiny

For many people, the word “investing” conjures images of stressed-out men in suits yelling on the floor of the stock market. It feels risky, complicated, and only for the rich.

It’s time to bust that myth.

Investing is simply making your money work for you by earning a return. Thanks to the miracle of compound interest—where your earnings start generating their own earnings—even small, consistent investments can grow into staggering amounts over time.

Think of it like a snowball rolling down a hill. It starts small, but as it rolls, it picks up more and more snow, growing larger and gaining speed. Time is the most critical ingredient.

How to Start Investing for Total Beginners:

- Leverage Your Employer’s 401(k): If your job offers a 401(k) retirement plan with an employer match, this is your number one priority. An employer match is literally free money. If they offer to match 50% of your contributions up to 6% of your salary, you should contribute at least 6% to get the full match. It’s an instant 50% return on your investment.

- Open a Roth IRA: This is a fantastic retirement account for most people. You contribute money you’ve already paid taxes on, and then it grows completely tax-free. You can withdraw your contributions (but not the earnings) at any time without penalty, and you can withdraw everything tax-free after age 59½.

- Keep It Simple: Index Funds and ETFs: You don’t need to pick individual stocks. For 99% of people, the best investment is a low-cost, broad-market index fund or ETF (Exchange-Traded Fund). These are like buying a tiny piece of the entire U.S. stock market (or bond market) in a single purchase. They are diversified, low-cost, and have historically provided excellent long-term returns.

You can start with as little as $25 or $50 a month. The key is to start now.

7. The Power of “No”: Align Your Spending With Your Values

Budgeting isn’t just about numbers; it’s about values. It’s about deciding what is truly important to you and directing your money toward those things, while consciously cutting back on the things that aren’t.

This is where you move from passive spender to intentional consumer.

The “Values vs. Expenses” Audit:

Look back at your spending tracking from Tip #1. Now, ask yourself for each category: “Does this spending bring me genuine joy, add value to my life, or align with my long-term goals?”

You might realize that spending $100 a month on new clothes feels “meh,” but that spending $60 on a nice dinner with your best friend is priceless. Or you might find that you’re spending a fortune on a fancy cable package you never use, but you’d get immense value from putting that money toward a weekend trip.

This process allows you to:

- Cut the “Fat” Without Feeling Deprived: Canceling a subscription you don’t use doesn’t feel like a sacrifice; it feels like a smart decision. Making your coffee at home feels good when you realize you’re saving $150 a month for a vacation you’re truly excited about.

- Spend More on What You Love: When you cut out the mindless spending, you free up cash to spend more on the things that truly make you happy, guilt-free. If you love live music, your budget can include a “concert fund.” This is the essence of a budget that doesn’t feel restrictive.

8. Look Ahead: Set Specific, Exciting Financial Goals

“Save more money” is a vague and uninspiring goal. “Save $3,000 for a trip to Italy in 18 months” is specific, exciting, and gives you a clear target to work towards.

Goals turn abstract financial concepts into a tangible reality. They are the motivation that keeps you going when you’re tempted to overspend.

How to Set S.M.A.R.T. Financial Goals:

- Specific: What exactly do you want? (e.g., “A new car down payment”)

- Measurable: How much money do you need? (e.g., “$5,000”)

- Achievable: Is it realistic for your income? (e.g., “Yes, if I save $200 a month”)

- Relevant: Does it matter to you? (e.g., “Yes, my current car is unreliable.”)

- Time-Bound: When do you need it by? (e.g., “In 25 months”)

Examples of Powerful Goals:

- Short-Term (0-1 year): Build a $1,000 emergency fund in 10 months. Pay off $2,000 of credit card debt by the end of the year.

- Mid-Term (1-5 years): Save a $15,000 down payment for a house in 3 years. Save $4,000 for a dream wedding in 2 years.

- Long-Term (5+ years): Have $50,000 in my child’s college fund in 18 years. Be on track to retire at 65 with a million-dollar portfolio.

Write your goals down. Put a picture of your goal on your fridge or as your phone’s wallpaper. Let your goals, not your impulses, guide your spending decisions.

9. Make It a Regular Check-In: Your Monthly Financial “State of the Union”

Your finances aren’t static; they’re a living, breathing part of your life. Income changes, expenses fluctuate, and goals evolve. Setting your budget on January 1st and never looking at it again is a recipe for failure.

Schedule a monthly money date with yourself. Block out 30-60 minutes on your calendar once a month. Make it enjoyable—get a cup of coffee, put on some music.

During this time, you will:

- Review Last Month: Look at your bank and credit card statements. Did your spending align with your budget? Where did you overspend? Where did you underspend?

- Adjust for the Coming Month: Did you forget about an annual subscription that’s coming up? Is it someone’s birthday next month? Adjust your budget categories to reflect reality.

- Check Progress on Goals: How much did you add to your emergency fund? How much closer are you to your vacation goal? Celebrate the progress, no matter how small!

- Brainstorm and Problem-Solve: If you overspent in one category, where can you pull from to cover it? What can you do differently next month?

This monthly ritual transforms money management from a reactive, stressful chore into a proactive, empowering habit.

You’ve Got This

Improving your finances isn’t about perfection. It’s about progress. It’s about making more conscious choices, one day at a time. You will have months where you nail your budget and months where life throws a curveball and you blow it. That’s okay. The key is to get back on track.

Start with just one of these tips. Maybe this week, you just start tracking your spending. Next month, you set up that automatic savings transfer. The month after, you open a Roth IRA with $50.

Every small step you take is a vote for a more confident, secure, and empowered financial future. The control you’ve been looking for? It’s been in your hands all along. Now you have the map. It’s time to start the journey.