The Invisible Cage: Why It Feels Like You’re Running on a Financial Treadmill (And How to Finally Step Off)

You work hard. You show up on time, you put in the hours, and at the end of the week or month, your paycheck lands in your account. There’s a brief moment of relief. You pay the rent, the car payment, the utilities. You buy groceries. You maybe even treat yourself to a meal out because, hey, you’ve earned it.

And then, with a week left until the next payday, you’re looking at your bank balance with that familiar, sinking feeling. The money is gone. Again.

It feels like you’re on a treadmill, running just to stay in the same place. You watch others seemingly get ahead—they’re taking vacations, buying homes, saving for retirement—and it feels like they have a secret you weren’t let in on.

The truth is, staying broke isn’t just about not having enough money. For millions of people, it’s a cycle. It’s a set of invisible traps, mental models, and societal pressures that keep them running in place, no matter how fast their legs move.

The good news? This cage has a door. It’s not always easy to find, and it certainly takes effort to open, but it’s there. This isn’t about getting rich quick. It’s about understanding why you’re stuck and taking real, actionable steps to break free.

Part 1: The Scarcity Mindset – The Broken Internal Compass

At the heart of the cycle of being broke is a psychological state known as the Scarcity Mindset. When you’re constantly worried about not having enough, your brain actually changes how it operates.

What it looks like in real life:

- The “I Deserve It” Tax: After a long, stressful week of pinching pennies, you feel you’ve earned a reward. A $100 night out, a new video game, a shopping spree. This isn’t just spending; it’s an emotional release valve. The problem is, this release sets you further back, reinforcing the scarcity and stress, which makes you crave another release. It’s a vicious cycle.

- Tunnel Vision: You’re so focused on the immediate crisis—making it to the next payday—that you can’t possibly lift your head to plan for next year, let alone the next ten years. You’re putting out financial fires instead of building a fireproof house. Long-term planning feels like a luxury you can’t afford.

- The High Cost of Being Poor: When you’re broke, you can’t afford to buy in bulk, so you pay more per unit. You can’t afford a reliable car, so you’re constantly paying for repairs on a cheap one. You can’t afford the security deposit for a nicer apartment, so you pay more in rent for a worse place. Your credit is bad, so you pay exorbitant interest rates. Being broke is incredibly expensive.

Your brain, in survival mode, prioritizes the immediate relief of stress over the long-term stability that requires short-term discomfort. It’s a rational response to a stressful situation, but it’s a recipe for staying stuck.

Part 2: The Myths That Keep Us Broke

We’re fed a steady diet of financial fairy tales that keep us from seeing the real path forward.

Myth #1: “More Money is the Answer.”

This is the biggest one. “If I just made $10,000 more a year, all my problems would be solved.” It’s a seductive lie. The reality is that without a change in mindset and habits, lifestyle inflation will eat that raise every time. You’ll get a better car, a slightly nicer apartment, and more expensive hobbies, and you’ll be just as broke as before, just with fancier stuff. Your financial situation is more about your habits than your income.

Myth #2: “You Need to Be a Genius to Understand Money.”

The financial world loves its jargon—compound interest, ETFs, asset allocation. It makes things seem complicated so you feel you need to rely on “experts.” The fundamentals of wealth-building are simple. Spend less than you earn. Save the difference. Make your savings work for you. It’s simple, but it’s not easy. The barrier isn’t intellect; it’s discipline and a little bit of knowledge.

Myth #3: “It’s Too Late for Me to Start.”

Whether you’re 25, 45, or 65, this myth is a dream killer. The best time to plant a tree was 20 years ago. The second-best time is today. Compound interest is a powerful force, but so is simply deciding to stop digging yourself deeper. Getting out of debt and building a small emergency fund are massive wins that transform your life at any age.

Part 3: The Practical Traps – The Systems Working Against You

Beyond our psychology, there are very real, practical traps that are incredibly easy to fall into.

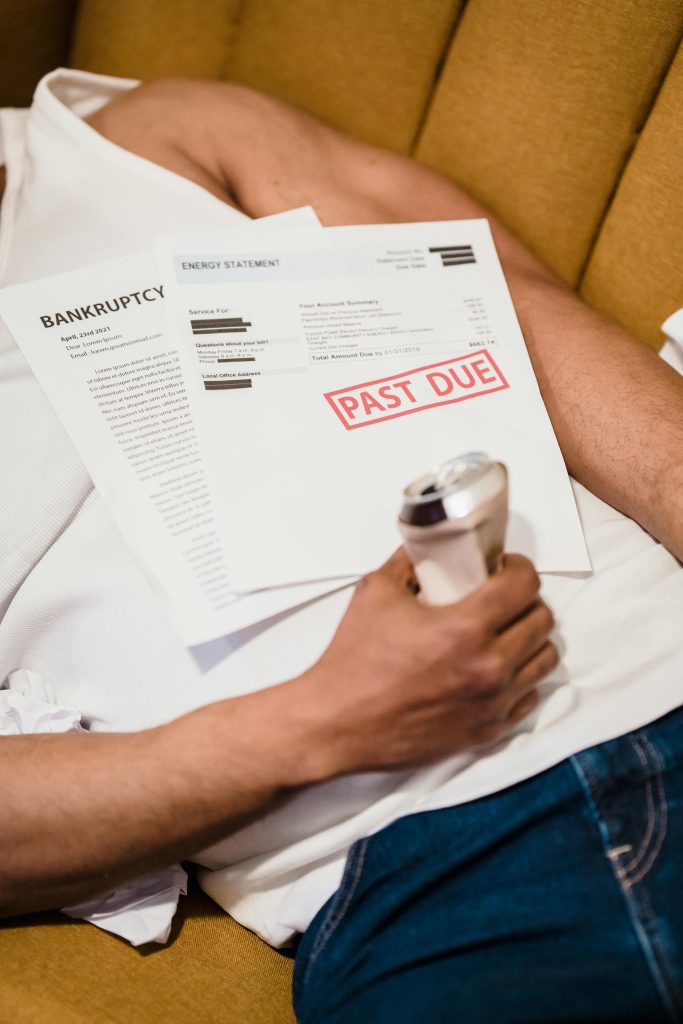

The Debt Spiral: The Quicksand

This is often the point of no return for the broke cycle. High-interest debt, especially from credit cards or payday loans, is quicksand. The minimum payments are so high they consume your disposable income, forcing you to rely on the cards again just to get by. You’re working solely to pay interest to a bank, not to build a life for yourself. It feels inescapable.

The Lack of an Emergency Fund

Without a financial cushion, every minor problem becomes a major catastrophe. A $300 car repair isn’t an inconvenience; it’s a crisis that forces you to put it on a credit card, deepening the debt spiral. An emergency fund isn’t a savings account; it’s a force field that protects your fragile financial system from the shocks of life.

The Invisible Budget (or No Budget at All)

Most people who are broke have no idea where their money is actually going. It’s like trying to drive to a new destination without a map or GPS. You make turns (spending decisions) based on how you feel in the moment, and you end up lost. Without tracking your income and expenses, you are financially blindfolded.

Breaking the Cycle: Building Your Ladder Out of the Trap

Understanding the problem is 80% of the battle. The other 20% is action. Here is your step-by-step guide to building your ladder and climbing out.

Step 1: The Mindset Shift – From Scarcity to Abundance

This is the foundation. Everything else will crumble without it.

- Forgive Yourself: The first step is to stop the shame spiral. You are not bad with money. You’ve just been using bad strategies. Forgive your past self for their financial mistakes. Your present self is now taking over.

- Focus on What You Control: You can’t control the economy or inflation. But you can control your spending, your effort at work, and the skills you learn. Redirect your energy from worry to action.

- Practice Gratitude: It sounds fluffy, but it’s powerful. When you focus on what you do have—your health, your skills, a roof over your head—it shrinks the feeling of scarcity and opens your mind to opportunities.

Step 2: The Financial Triage – Stop the Bleeding

Before you can build, you have to stop the demolition.

- The Spending Autopsy: For one month, track every single penny you spend. No judgment, just data. Use a notebook, an app, whatever works. You must shine a light on the invisible leaks. You will be shocked at where your money is actually going.

- Declare a “No-Spend” Month: This is a radical reset. For 30 days, you only spend money on absolute essentials: rent, utilities, basic groceries, and gas. No restaurants, no new clothes, no entertainment that costs money. It’s not forever, but it’s a bootcamp for your spending habits. It forces creativity and shows you how much you can save when you’re focused.

- The Debt Avalanche: List all your debts from the highest interest rate to the lowest. Pay the minimum on all of them except the one at the top. Throw every extra dollar you can find at that top debt. When it’s gone, roll all the money you were putting toward it into the next one on the list. This is the mathematically fastest way to get out of debt.

Step 3: Building Your Foundation – The Three Pillars

With the bleeding stopped, you can now build something solid.

Pillar 1: The Emergency Fund

Your new number one financial priority. Before extra debt payments, before investing, build this.

- Stage 1: Save $1,000 as fast as humanly possible. This is your “break in case of emergency” fund for small crises.

- Stage 2: Build it to 3-6 months of your essential living expenses. This is your “I can lose my job and survive” fund. This can take a year or two, and that’s okay. Keep this money in a separate savings account.

Pillar 2: The Simple Budget That Actually Works

Forget complex spreadsheets. Use the 50/30/20 Rule as a guide:

- 50% for Needs: Rent, groceries, utilities, minimum debt payments.

- 30% for Wants: Dining out, hobbies, shopping, entertainment.

- 20% for Savings/Debt: Your emergency fund and extra debt payments.

If your needs are more than 50%, adjust the other categories. The point is the principle: prioritize your future.

Pillar 3: Increase Your Income

Remember, more money alone isn’t the answer, but it is a powerful tool when combined with good habits.

- Ask for a Raise: Document your accomplishments and ask. The worst they can say is no.

- Start a Side Hustle: Use a skill you have. Drive for Uber, walk dogs, freelance, tutor. Use this extra income only for your debt avalanche and emergency fund. Don’t let it inflate your lifestyle.

Step 4: Playing the Long Game – From Broke to Builder

Once you’re out of debt and have a full emergency fund, you’ve officially broken the cycle. Now, you become a builder.

- Invest in Your Retirement: If your job offers a 401(k) with a match, contribute enough to get the full match. It’s free money. If not, open a Roth IRA. You don’t need to be a stock-picking genius. Put your money in a low-cost index fund that tracks the whole stock market (like an S&P 500 fund). Set up automatic contributions and forget about it. Let compound interest, your new best friend, do the work.

- Invest in Yourself: The highest return on investment you’ll ever get is in your own skills. Take a course. Get a certification. Read books. Become more valuable in the marketplace.

The New Reality

Breaking the cycle of being broke isn’t about a single lucky break. It’s a slow, deliberate process of replacing bad habits with good ones, of trading short-term gratification for long-term peace of mind.

The treadmill will stop. The panic will fade. You’ll start to feel something you may have forgotten: a sense of agency. You are not a victim of your finances. You are the architect.

It starts with a single, defiant decision to no longer accept the cycle as your fate. Your future self is waiting for you to make it.