You know that feeling. It’s a low hum in the background of your life. A whisper that says, “There’s never enough.” It shows up when you’re nervously checking your bank balance before a grocery run. It shouts in your ear when a friend gets a promotion, and your first, secret thought is, “Why them and not me?” It’s the cold clutch in your stomach when an unexpected bill arrives, a confirmation of your deepest fear: that you’re always one step away from falling behind.

We often think of our financial reality as a simple math equation. Income minus expenses equals our life. If we could just get a raise, nail that side hustle, or catch a lucky break, everything would click into place.

But what if the math is secondary? What if there’s a hidden, silent architect drawing up the blueprints for your financial life long before the numbers ever hit the page?

That architect is your mindset. And its most powerful, and often most destructive, design is something called scarcity thinking.

This isn’t about positive-thinking-magic or blaming you for your circumstances. This is about a fundamental truth backed by psychology and observable reality: your beliefs don’t just shape how you feel about money. They actively shape the decisions you make, the opportunities you see (or miss), and the financial landscape you ultimately inhabit.

Scarcity thinking is the deep-seated belief that resources, money, time, love, and opportunities are severely limited. It’s a worldview of lack. In this mental universe, there is only so much pie to go around. If someone else gets a big slice, it automatically means less for you. Success is a lottery you probably won’t win. Security is a fragile illusion.

And here’s the kicker: this belief, whether you’re consciously aware of it or not, becomes a self-fulfilling prophecy.

The Scarcity Loop: How a Thought Becomes a Trap

Let’s break down how this works in the real world. It’s a vicious cycle, a closed loop that reinforces itself.

1. The Core Belief: It starts with the internal whisper. “Money is hard to get.” “Rich people are greedy.” “I’m just bad with numbers.” “I don’t deserve abundance.”* This belief isn’t based on a spreadsheet; it’s often absorbed from childhood experiences, cultural messages, or past financial shocks.

2. The Filtered Reality: Armed with this belief, your brain goes to work as a filter. It’s called the Reticular Activating System (RAS), and it’s basically your mind’s bouncer. It lets in information that confirms what you already believe and ignores the rest.

- If you believe “money is hard to get,” your RAS will highlight every story of struggle, every rejected job application, every instance of inflation. It will conveniently ignore the story of the local person who started a successful small business, the freelance opportunity a friend mentions, or the manageable budget adjustment you could make.

- You literally stop seeing possibilities. Your world shrinks to confirm your fear.

3. The Fear-Based Action (or Inaction): This filtered view leads to decisions made from fear, not from clarity or strategy.

- Hoarding & Pinching: You might clutch every penny so tightly that you miss smart investments in yourself, a course that could advance your career, fixing the car part that will save on gas, and buying quality items that last. You see only outflow, not potential growth.

- Opportunity Blindness: That network event? “A waste of time.” That collaborative project? “They’ll probably take all the credit.” You say no, not after rational consideration, but from a place of protective lack.

- Self-Sabotage: You might unconsciously undermine a raise negotiation because deep down, you don’t feel you’re worth it. Or you’ll make an impulsive “treat yourself” splurge because the grind of scarcity feels so bleak, reinforcing the cycle of feast-or-famine.

4. The Reinforcing Result: These fear-based actions lead to predictable outcomes: stagnation, missed chances, and recurring financial stress. And what does your brain do with this result? It points to it and says, “See? I told you so. There’s never enough.” The core belief is hardened, cemented. The loop is complete and ready to run again.

You’re not stuck because you’re unlucky or unintelligent. You’re trapped in a psychological loop that’s designing a reality of limitation.

From Scarcity to Abundance: Rewiring the Blueprint

The powerful news is this: if a mindset can be learned, it can be unlearned. You can fire the architect of lack and hire a new one. This new mindset is often called abundance thinking. It’s not a Pollyannaish belief that money grows on trees. It’s a pragmatic, open-eyed understanding that resources, while not infinite, are often more fluid, creatable, and shareable than a scarcity mindset allows.

Abundance thinking says, “There is enough for me to work with, to learn, to grow, and to build something.” It shifts the focus from a fixed pie to a flexible kitchen where new pies can be made.

Breaking the scarcity loop is a practice, not a proclamation. It’s a series of deliberate, sometimes small, actions that build new neural pathways. Here’s how to start:

Phase 1: Become a Detective of Your Own Mind

You can’t change what you don’t see. Start listening to your internal financial dialogue.

- When you see a nice car, what’s the immediate thought? “Show-off” or “Good for them”?

- When you consider asking for more money, what feeling arises? Dread or rightful claim?

- When a friend succeeds, what’s the gut reaction? Jealousy or inspiration?

- The Practice: Keep a “money thought journal” for one week. No judgment, just observation. Write down the triggering event and the immediate, uncensored thought. You’ll uncover your core scripts.

Phase 2: Challenge and Replace the Code

Once you catch a scarcity thought, don’t just accept it as truth. Interrogate it.

- Thought: “I’ll never get out of debt.”

- Challenge: “Is that literally true? Has no one in history ever gotten out of debt? What’s one tiny step I could take today that would move me 1% in the right direction—even if it’s just making a clear list of what I owe?”

- Replace: “My current debt feels overwhelming, but it is a temporary situation, not my permanent identity. I am capable of learning and following a plan to manage it.”

Phase 3: Actively Install Abundance Evidence

Your RAS needs new data. You must consciously feed it proof that contradicts the old story.

- Practice Gratitude for What Is: This is foundational. Scarcity focuses on what’s missing. Abundance acknowledges what’s present. Every day, write down 3-5 specific, non-monetary things you’re grateful for: your health, a sunny day, a warm bed, a loyal friend, clean water. This physically rewires your brain to scan for “enough” rather than “lack.”

- Celebrate Others’ Wins: This is a secret weapon. When someone gets a raise, lands a client, or buys a home, sincerely congratulate them. Say it out loud: “That’s amazing! Tell me how you did it!” This trains your subconscious that success is not a threat to your supply; it’s proof that good things are possible. It dissolves jealousy and opens you to learning.

- Focus on Value Creation, Not Just Money Capture: Scarcity thinks, “How do I get more money?” Abundance asks, “How can I become more valuable?” Shift your energy to skill-building, problem-solving, helping others, and creating quality work. Money is a echo of value provided. As your value grows, the channels for compensation will multiply in ways your old mindset couldn’t see.

- Embrace “And” Thinking: Scarcity deals in “either/or.” “I can either save for a vacation OR have fun now.” Abundance explores “and.” “How can I save for a vacation AND find low-cost ways to enjoy my present?” This opens creative problem-solving.

Phase 4: Make Small, Brave Decisions from the New Mindset

Belief is solidified through action. Make choices that feel aligned with abundance, even if they’re small.

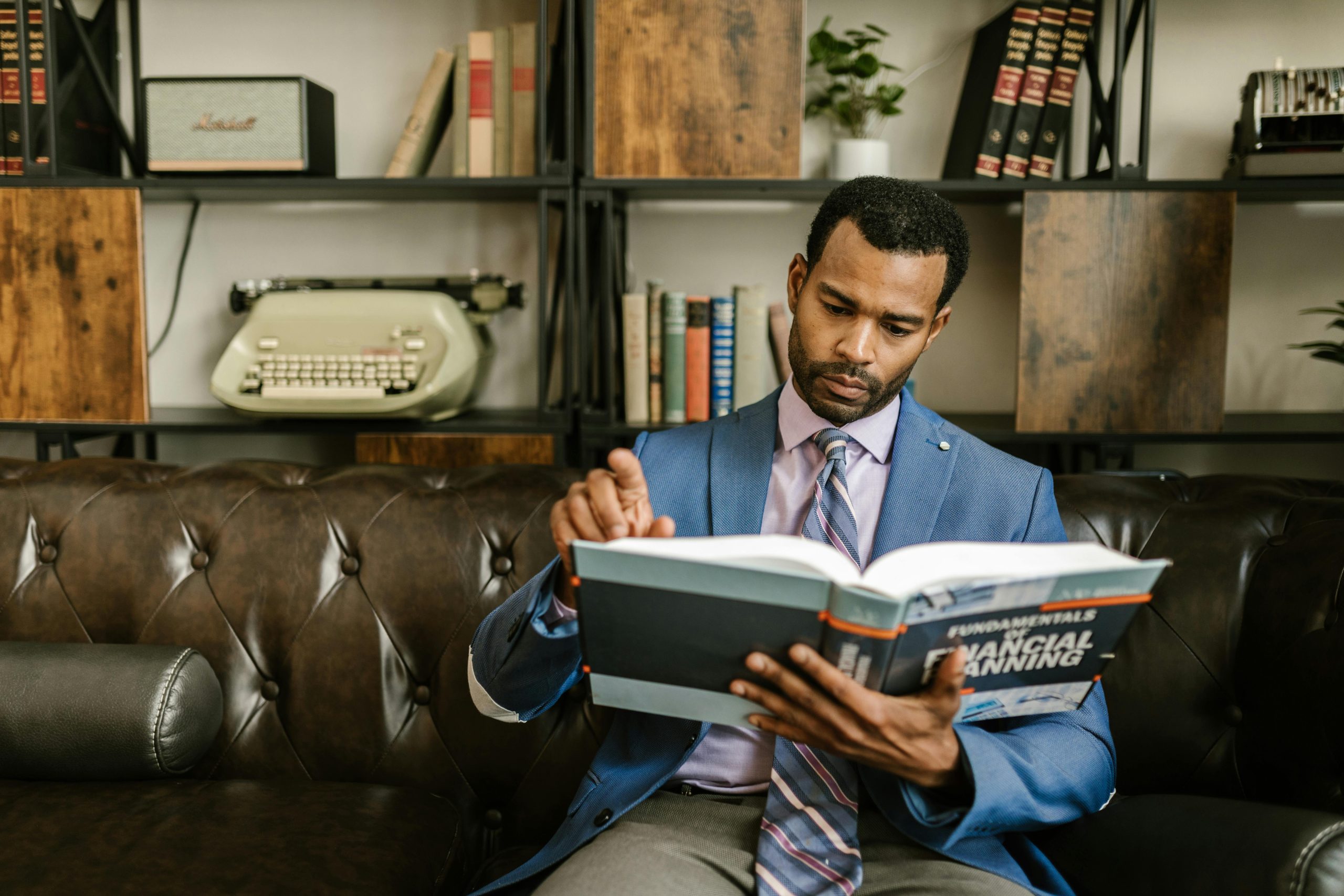

- Invest in Yourself: Buy that book. Sign up for that webinar. It’s not an expense; it’s planting a seed.

- Tip Generously & Give When You Can: Nothing breaks the spirit of clutching scarcity like the conscious, joyful act of giving. It affirms, “I have enough to share.”

- Negotiate Your Worth: Ask for the raise, the higher rate, the better deal. Do it from a place of the value you provide, not from desperate need.

- Visualize with Specifics: Don’t just wish for “more money.” Get specific. What does financial security feel like? Is it the peace of a 6-month emergency fund? The freedom to work 4 days a week? Picture the details. Emotion fuels action.

The Ripple Effect: When Your Financial Mindset Changes Everything

This work does more than just improve your bank statements. It changes the quality of your entire life.

- Reduced Anxiety: The constant background hum of worry quiets. You deal with numbers from a place of clarity, not panic.

- Better Decisions: You move from impulsive, fear-driven reactions to strategic, long-term planning. You see options where you once saw dead ends.

- Increased Creativity: When you’re not in survival mode, your brain has the space to innovate, to see connections, to imagine new streams of income or solutions to old problems.

- Healthier Relationships: Money stress is a prime relationship killer. As you find your own footing, you stop projecting financial anxiety onto your partner, family, and friends. Conversations about money become collaborative, not confrontational.

The Beautiful Truth About the Pie

Remember the scarcity myth of the limited pie? The profound shift happens when you realize the world doesn’t operate on a single, static pie.

Some pies are indeed finite; you have to hustle for your slice. But more often, you are in a kitchen. And in a kitchen, you can learn new recipes. You can grow your own ingredients. You can trade your amazing apple pie for your neighbor’s fantastic lemon meringue. You can even teach others to bake, expanding the entire community’s dessert selection.

Your financial reality is not a pre-served plate. It is a kitchen you are learning to operate. Your beliefs are the recipe book you’ve been using. Scarcity thinking offers only one, grim recipe for struggle.

Breaking scarcity thinking means tossing out that old, stained book and realizing you have the ability to write new recipes. It starts with the belief that you are capable of learning, of creating, of building, and of receiving. It starts with the quiet, courageous decision to stop whispering “never enough,” and to begin declaring, “I have enough to start.”

Your bank account, in time, will simply become a reflection of that new, and much more powerful, reality.