Your Phone is Your Wallet: A No-BS Guide to Taming Your Money in the Digital Age

Remember the sound? That satisfying cha-ching of a cash register, or the crisp rustle of new bills from the bank teller. For generations, money was a physical thing. You could hold it, count it, and—most importantly—feel it leave your hands. When the cash in your envelope or wallet was gone, you were done spending. It was a simple, tactile system.

Now, money is… invisible.

It’s a number on a screen. A swift tap of a phone at a coffee shop. A one-click purchase from the comfort of your couch at 2 AM. It’s a subscription that silently drains from your account every month, a ride-share fare you barely think about, and a digital payment to split dinner with friends.

This digital revolution has made life incredibly convenient, but it’s also completely broken the old rules of budgeting. Trying to manage your money with a pen, paper, and a stack of receipts in the 21st century is like trying to navigate a superhighway with a horse and cart. It’s not just inefficient; it’s a recipe for feeling lost, anxious, and constantly wondering, “Where did all my money go?”

If you’ve ever felt that way, you’re not alone. This isn’t a sign that you’re bad with money. It’s a sign that you’re using an outdated map for a new world.

The good news? The very technology that complicates our financial lives also holds the key to mastering it. This guide isn’t about deprivation or complex spreadsheets. It’s about building a modern, flexible, and—dare I say—even enjoyable money management system that works with your digital life, not against it.

Part 1: The Digital Money Trap (Why Your Paycheck Vanishes)

Before we can build a new system, we need to understand what we’re up against. Our brains aren’t wired for digital spending. The pain of parting with physical cash is a powerful psychological check on our spending. Digital payments remove that friction, and companies have become masters at exploiting this.

1. The Illusion of Abundance: When you can’t see or touch your money, it feels less real. Swiping a card or tapping a phone creates a disconnect between the purchase and the consequence. That $50 spent on delivery apps feels the same as $5 spent on a coffee—it’s all just a digital transaction. This creates a false sense of security, making it easy to overspend without realizing the cumulative impact.

2. Subscription Creep: The Silent Budget Assassin: This is arguably the biggest culprit of the digital age. It starts innocently enough: a streaming service for $14.99, a cloud storage plan for $2.99, a monthly box of goodies for $39.99. Individually, they seem manageable. But together, they form a “phantom limb” of your budget—constantly draining your account. Before you know it, you’re paying $150 a month for services you barely use, all on auto-pilot.

3. The One-Click, Impulse-Buy Economy: Online retailers have spent billions perfecting the art of the impulse buy. “Buy Now with 1-Click.” “Only 3 left in stock!” “Customers who bought this also bought…” These aren’t accidents; they are carefully crafted psychological triggers designed to bypass your rational brain. The frictionless nature of digital commerce means a moment of boredom or a targeted ad can instantly turn into a real financial decision.

4. The “Digital Latte” Effect: The old financial advice warned against the “latte effect”—the idea that small, daily luxuries add up to a surprising amount over time. In the digital world, this effect has exploded. It’s not just coffee. It’s in-app purchases, micro-transactions in mobile games, topping up your digital wallet, paying for express shipping, and buying digital books or music on a whim. These tiny, painless transactions are the termites nibbling away at your financial foundation.

Recognizing these traps is the first step to disarming them. The goal isn’t to eliminate all digital spending—that’s neither practical nor desirable. The goal is to bring awareness and intention back into the process.

Part 2: Laying the Foundation: Your Money Mindset in a Digital World

You can download every budgeting app on the planet, but if your mindset isn’t right, you’ll end up frustrated. A 21st-century budget isn’t a straitjacket; it’s a GPS for your finances. It’s not about saying “no” to everything; it’s about saying “yes” to the things that truly matter to you.

Shift from Restriction to Empowerment: Stop thinking of a budget as a tool of deprivation. Instead, see it as a tool of empowerment. It’s the plan that funds your life—your vacations, your hobbies, your security, your future. Every dollar you consciously direct is a vote for the life you want to live.

Embrace Financial Fluidity: Your income and expenses aren’t always static. The gig economy, freelance work, and variable hours mean your paycheck might change month to month. A modern budget needs to be fluid. It’s less about rigid categories and more about percentages and priorities. It’s okay to adjust as you go!

Define Your “Why”: This is the most crucial step. Why do you want to get a handle on your money? Is it to quit a job you hate? To travel the world? To provide a secure future for your family? To simply sleep better at night without financial anxiety? Write your “why” down and put it somewhere you can see it. This is your motivation when the going gets tough.

Part 3: Building Your 21st-Century Budgeting System

Forget the complex spreadsheets of the past. Here are three modern, digital-friendly methods you can start using today. The best one is the one you’ll actually stick with.

Method 1: The Digital Envelope System (A Classic, Reborn)

You’ve probably heard of the cash envelope system, where you put physical cash for categories like “Groceries” and “Entertainment” into labeled envelopes. The digital version takes this proven concept and supercharges it for the modern age using apps.

How it works: You use a dedicated app that connects to your bank accounts. You then create virtual “envelopes” for your spending categories. When you spend money, you log the transaction and assign it to an envelope. The app automatically deducts it, so you can see exactly how much you have left for, say, “Eating Out” before you even walk into the restaurant.

The Magic: It recreates the visual and tactile feedback of using cash. You see the money in your “Fun Money” envelope dwindling, which makes you think twice before making another discretionary purchase.

Top App Picks:

- YNAB (You Need A Budget): The gold standard for this method. It’s proactive, powerful, and has a cult-like following for a reason. It forces you to “give every dollar a job.” (Subscription-based).

- Goodbudget: A great free version that mimics the envelope system perfectly. It’s based on the “envelope budgeting” methodology and is less about bank syncing and more about manual entry, which can increase awareness.

Best for: People who love the concept of cash budgeting but need a system that works with a digital, card-based life.

Method 2: The 50/30/20 Rule (The “Set-it-and-Forget-it” Approach)

If micromanaging categories sounds like a nightmare, this method is for you. It’s a framework for dividing your after-tax income into three simple buckets, based on percentages.

- 50% for Needs: This is your essential, can’t-live-without spending. Rent/Mortgage, utilities, groceries, minimum debt payments, basic transportation, and essential insurance.

- 30% for Wants: This is your fun money! Dining out, hobbies, shopping, entertainment, subscriptions, and travel.

- 20% for Savings & Debt Repayment: This is your future money. It goes to your emergency fund, retirement accounts (IRA, 401k), and any extra payments on high-interest debt.

How it works: Let’s say you take home $3,000 a month after taxes.

- Needs: $1,500 goes toward rent, groceries, etc.

- Wants: $900 is yours to spend guilt-free on whatever brings you joy.

- Savings/Debt: $600 goes to building your future.

The Magic: Its simplicity. You don’t need to track every single coffee. You just need to ensure your spending in each bucket stays within its percentage. You can use a simple app like Mint or PocketGuard to automatically categorize your transactions and see how you’re doing against these targets.

Best for: Those who want a big-picture, low-maintenance system that ensures they’re covering their bases without getting bogged down in details.

Method 3: The Pay-Yourself-First Budget (The Anti-Budget)

This is the most passive and powerful method of all. It flips traditional budgeting on its head. Instead of spending first and saving what’s left, you save first and spend what’s left.

How it works: The moment your paycheck hits your bank account, you automatically funnel a predetermined amount into your savings and investment accounts. You can set this up with automatic transfers through your bank or your employer’s direct deposit system (many allow you to split your paycheck into multiple accounts).

The money that remains in your checking account is yours to spend on both needs and wants for the rest of the month. No tracking, no categories. As long as your bills get paid and you don’t go into overdraft, you’re golden.

The Magic: It completely automates the most important part of your financial life—saving. It leverages the digital world’s power for good, using automation to build wealth without requiring willpower every single month.

Best for: Beginners, people who hate tracking, or anyone who consistently finds themselves with nothing left to save at the end of the month.

Part 4: Your Digital Money Toolkit: Apps & Hacks

Now that you’ve chosen your system, let’s talk about the tools that will make it sing.

Automation is Your Best Friend:

- Auto-Save: Set up recurring transfers from your checking to your savings account for the day after you get paid. “Out of sight, out of mind” is a powerful wealth-building strategy.

- Bill Pay: Automate all your fixed bills (rent, utilities, insurance) to avoid late fees and mental clutter.

- Round-Up Apps: Apps like Acorns or Chime round up your everyday purchases to the nearest dollar and invest or save the spare change. It’s a painless way to save without feeling a thing.

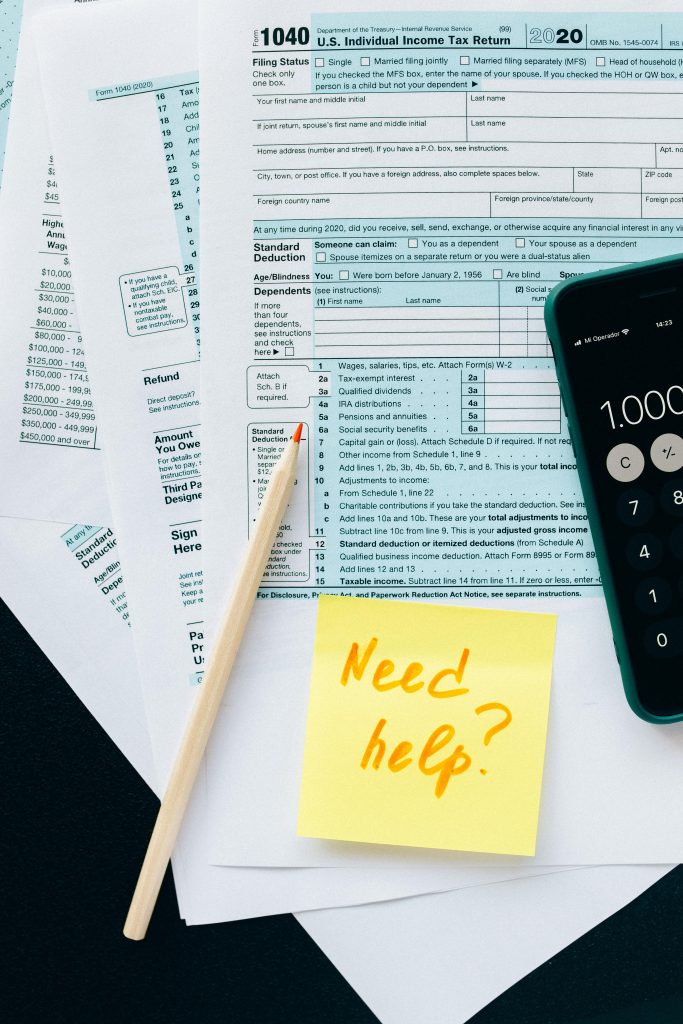

Taming the Subscription Beast:

- The Audit: This is a non-negotiable quarterly task. Go through your bank and credit card statements line by line. For every subscription, ask: “Do I use this regularly? Does it bring me $X of joy or value per month?” Cancel anything that doesn’t make the cut.

- Use a Subscription Tracker: Apps like Rocket Money or Truebill can connect to your accounts and identify all your recurring charges, making this audit process much easier.

Mastering Digital Payments:

- Separate Your Money: Use multiple bank accounts or “pots” within an account (offered by banks like Ally or Monzo). Have one account for bills, one for daily spending, and one for savings. This creates a digital version of the envelope system.

- Pause Before You Pay: Add a 24-hour rule for any online purchase over a certain amount (say, $50). Put it in your cart and walk away. If you still want it tomorrow, you can buy it. This simple hack kills the impulse buy.

Part 5: Beyond the Budget: Protecting Your Digital Financial Life

Managing your money in the digital world isn’t just about spending and saving; it’s also about protection.

1. Security is Paramount: Your phone is your wallet, so treat it that way.

- Use a strong, unique password and biometric locks (fingerprint, face ID).

- Never use public Wi-Fi for financial transactions.

- Enable two-factor authentication on all your financial and email accounts.

- Regularly check your accounts for any suspicious activity.

2. Understand Your Digital Footprint: Your data has value. Be mindful of what financial apps you use and what permissions you grant. Read the privacy policies. Stick with reputable, well-known companies.

3. Don’t Forget the Human Touch: While apps are incredible, sometimes you need a real person. Don’t be afraid to call your bank with questions or consider speaking with a fee-only financial planner for big life decisions. Technology is a tool, not a replacement for human wisdom.

The Journey Begins Now

Managing money in the digital world isn’t about fighting the tide of technology. It’s about learning to surf it. It’s about taking back control, replacing anxiety with awareness, and using the incredible tools at our fingertips to build a financial life that is not only secure but also joyful and aligned with our deepest values.

You don’t have to be perfect. You just have to start. Pick one method. Download one app. Do one subscription audit.

That satisfying cha-ching sound may be a relic of the past, but it’s been replaced by something even better: the quiet confidence of watching your savings grow, the peace of mind that comes from knowing exactly where your money is going, and the freedom to live your life on your own terms. That’s a sound worth listening for.